What are the fees and taxes to expect when buying a property in Thailand?

When buying real estate in Thailand, you should not only think about the purchase price. Several fees and taxes are added to the transaction, whether you buy a condominium, a house via leasehold or a land via a corporation.

In this article, we take a look at the main costs to anticipate to avoid unpleasant surprises.

Property transfer fees

The transfer fee is due when the property is registered with the Land Office . This cost is generally :

2% of the official value of the property (assessed by the administration, and not necessarily the market price).

This amount can be shared between the buyer and the seller, depending on what is agreed in the contract. In practice, it is often the buyer who takes care of the essentials.

Taxes applicable to the sale

1. The Specific Business Tax (SBT)

Rate: 3.3% (3% tax + 0.3% surcharge).

It is payable by the seller if the property has been held for less than 5 years.

If the property has been held for more than 5 years, this tax can be replaced by stamp duty.

2. Stamp duty

Rate: 0.5% of the official value or sale price (whichever is greater).

It is due if the sale is not subject to SBT.

It is also the seller who pays for it, unless otherwise agreed.

3. Withholding Tax

It applies to the seller’s earnings, at a rate that varies depending on whether the seller is an individual or a corporation.

For an individual, it depends on the length of time the property has been held and the progressive tax scale.

For a company, it is generally 1% of the sale price or official value.

Leasehold fees

If you opt for a leasehold , you don’t pay any transfer fees but:

1% of the total amount of the lease (over 30 years) as registration fees,

Sometimes a VAT of 7% if the landlord is a company subject to VAT.

These costs are generally the responsibility of the tenant (i.e. you).

Legal and notary fees

In Thailand, there is no notary in the French sense. He is a lawyer specialising in real estate law who is responsible for:

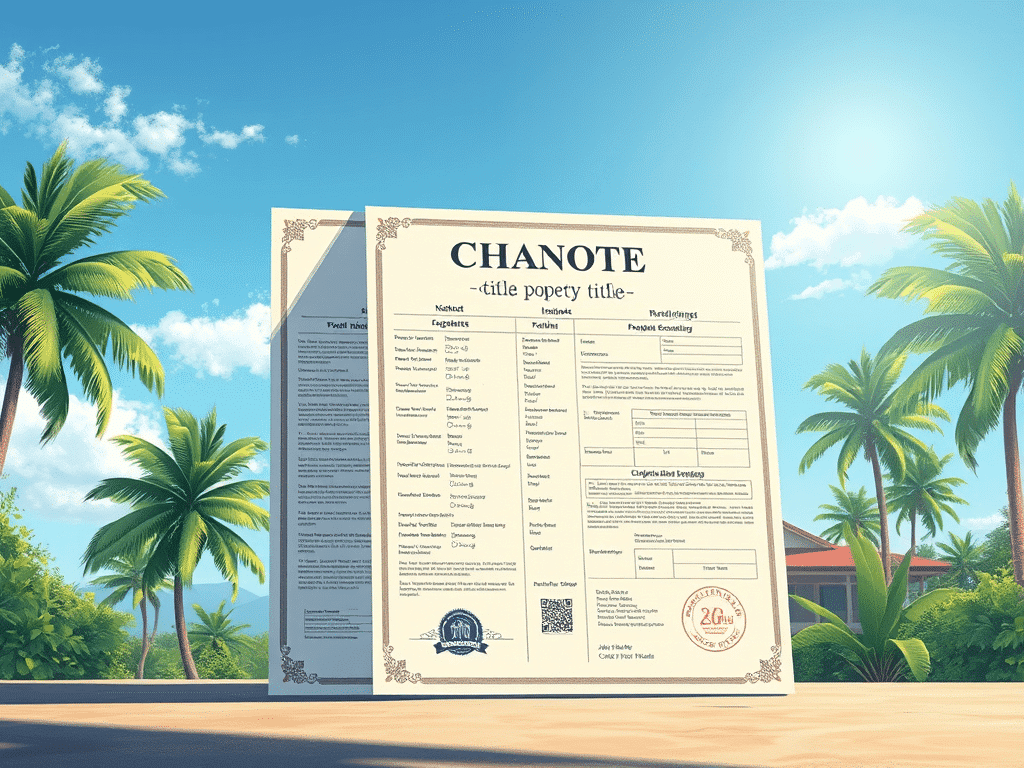

Verify title deeds,

Drafting or proofreading the purchase contract,

Accompany the registration at the Land Office.

Fees vary depending on the complexity of the case, but range from 25,000 to 60,000 THB on average.

Banking and money transfer fees

If you are a foreigner, the purchase must be made via a foreign currency transfer from your home country. International bank transfer fees may apply (usually between €15 and €50 depending on the bank).

A Foreign Exchange Transaction Form (FET) must also be obtained if the amount transferred exceeds $50,000. This document is essential for the registration of the property in your name.

Condominium fees (for a condominium)

Once you own a condominium, you will have to pay:

Annual management fees (between 30 and 60 THB/m²),

A contribution to the reserve fund (upon purchase),

Possible fees for additional services: security, swimming pool, maintenance, etc.

These fees are defined by the rules of the condominium.

Conclusion: Anticipate the costs associated with a property purchase in Thailand

Buying real estate in Thailand involves several fees and taxes beyond the sale price. By knowing them in advance, you can better budget for your project and avoid unpleasant surprises. It is strongly advised to clarify in the contract who pays what, and to call on a lawyer to provide a legal framework for the transaction.